Budgeting is an essential aspect of personal finance management, but many individuals find the process daunting or time-consuming. However, embracing a straightforward approach can streamline the budgeting process and offer effective financial control. The 50/30/20 rule is a simple yet powerful technique that offers a clear blueprint for managing monthly expenses and savings without the need for exhaustive tracking of every expenditure.

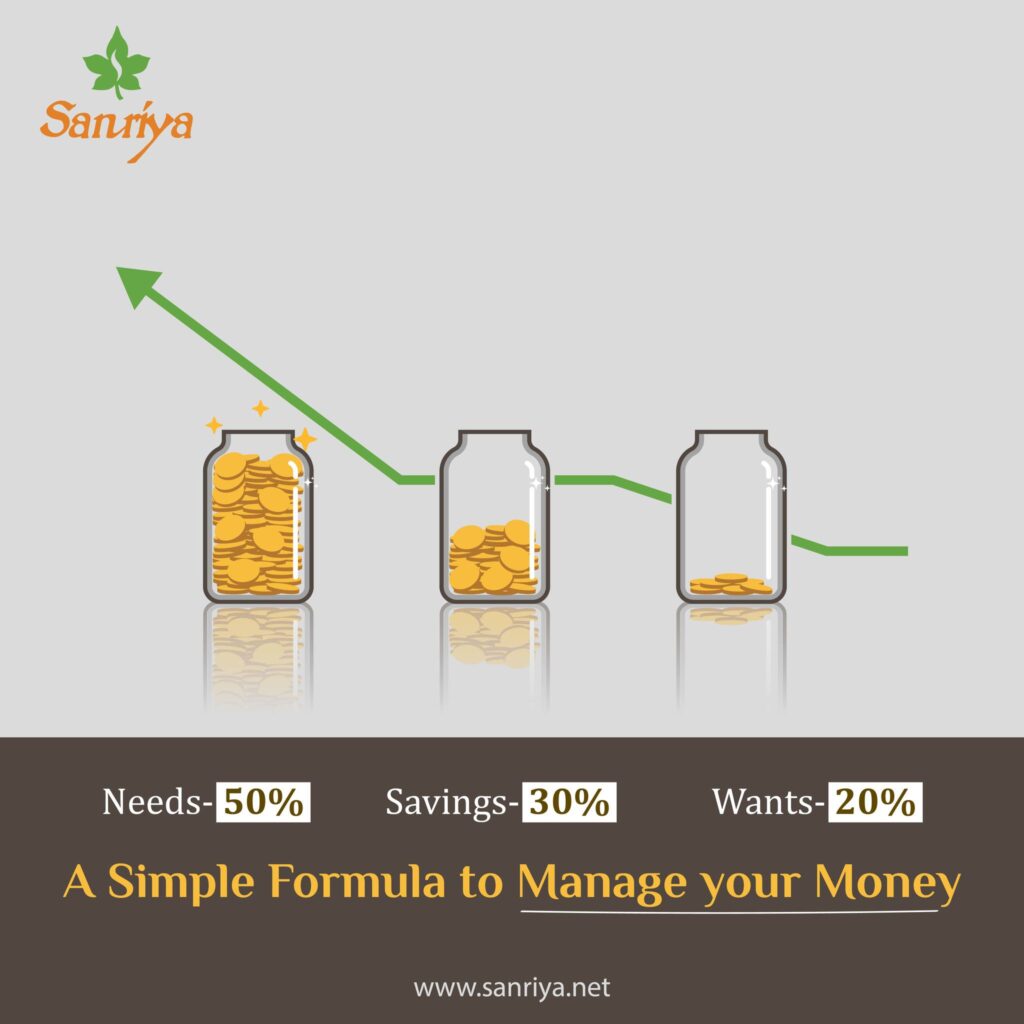

This rule divides your income into three main categories: needs, wants, and savings. It suggests allocating 50% of your income to essential needs, 30% to discretionary spending, and the remaining 20% to savings or debt repayment. This method provides a straightforward framework for individuals to understand how their income should be distributed, promoting a healthy balance between spending and saving.

The first category, covering 50% of your income, encompasses essential expenses such as housing, utilities, groceries, transportation, insurance, and minimum debt payments. These are crucial for maintaining your standard of living and are considered non-negotiable expenditures.

The 30% allocation for wants allows flexibility for discretionary spending. This category covers non-essential expenses like dining out, entertainment, hobbies, travel, and other indulgences. It provides the freedom to enjoy life’s pleasures while maintaining financial discipline.

The remaining 20% is allocated to savings or debt repayment. This portion fosters financial security by building savings for emergencies, retirement, investments, or aggressively paying off debts. Over time, this allocation helps to strengthen your financial position and create a safety net for unexpected expenses.

The beauty of the 50/30/20 rule lies in its simplicity and adaptability. It offers a clear guideline without requiring meticulous tracking of every purchase, providing a broad overview of where your money should be directed. This approach simplifies the budgeting process, making it accessible to individuals regardless of their financial expertise.

Adopting the 50/30/20 rule encourages mindful spending without feeling overwhelmed by complex financial calculations. It allows for better financial decision-making, helps avoid overspending, and cultivates a habit of consistent saving, thereby contributing to long-term financial stability.