Choosing the right stocks to invest in can be a daunting task, given the thousands of options available. However, by following a few key steps, you can make the process simpler and increase your chances of picking worthwhile stocks for your investment portfolio.

- Set Clear Goals: The first step is to establish your investment goals. What do you want to achieve with your portfolio? Are you looking for long-term growth, income, or a mix of both? Understanding your objectives will guide your stock selection process.

- Select a Sector: It’s a good idea to focus on a sector or industry that interests you or that you are familiar with. For instance, if you have a keen interest in technology, you might consider investing in tech stocks. Staying connected to a sector you’re passionate about can make it easier to follow the news and trends related to it.

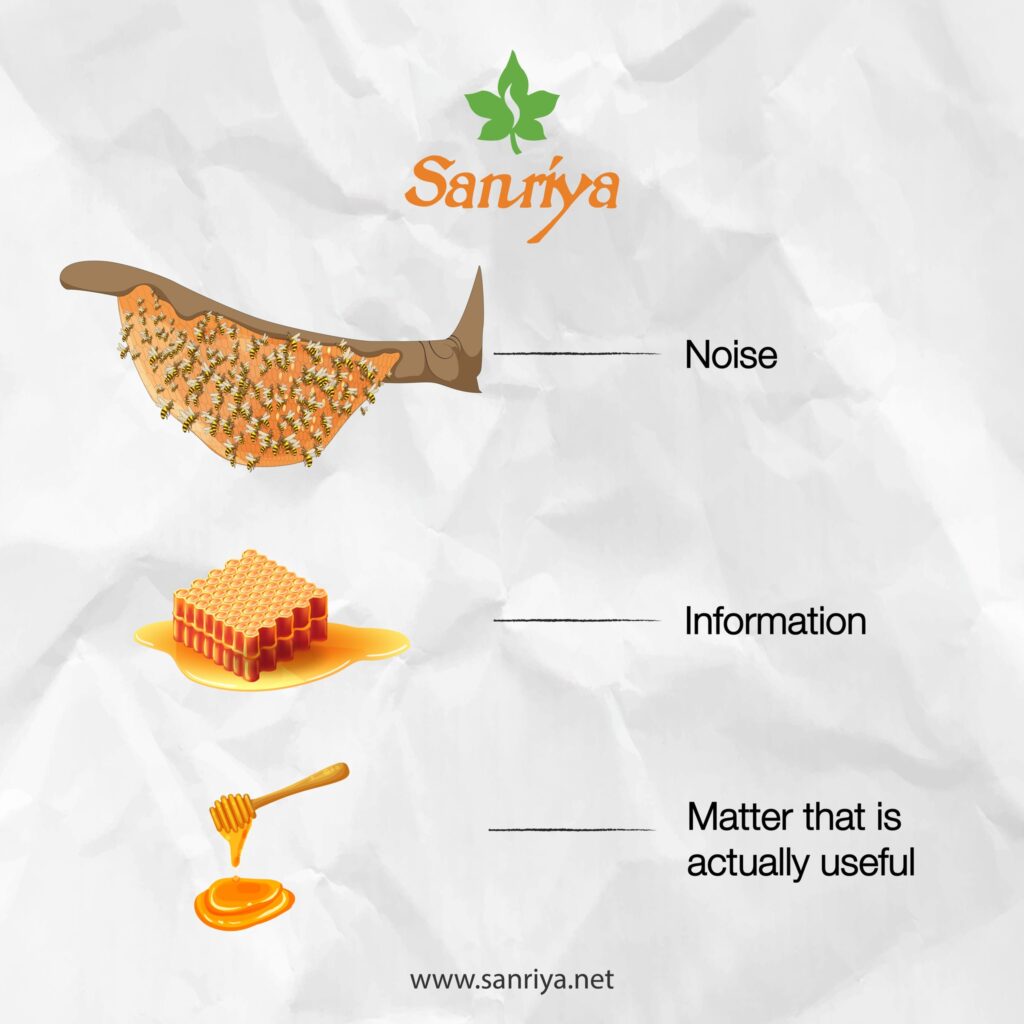

- Stay Informed: Keep yourself updated on the latest news and trends within your chosen sector. You can do this by reading financial news websites, following relevant social media accounts, or subscribing to industry-specific newsletters. Understanding what’s happening in the sector will help you make informed investment decisions.

- Analyze Financials: Pay close attention to the financial performance of the companies within your chosen sector. Look at key financial metrics like revenue, profit margins, and earnings growth. These numbers can provide valuable insights into a company’s health and potential for growth.

- Leaders in the Sector: Identify the leading companies within the sector. These are often referred to as “blue-chip” stocks. They tend to be well-established, financially stable, and have a track record of consistent performance. While they may not offer the same explosive growth potential as smaller companies, they can be more reliable and less risky.

- Diversify: Diversification is a crucial strategy. Instead of putting all your money into a single stock, consider spreading your investments across multiple companies or sectors. Diversification helps reduce risk because if one investment doesn’t perform well, the others may offset the losses.

- Do Your Own Research: While it’s essential to gather information from various sources, don’t rely solely on others’ opinions. Conduct your own research and analysis. Look at a company’s annual reports, listen to earnings calls, and explore their competitive position in the market.

- Risk Tolerance: Consider your risk tolerance. Some stocks come with more significant risks but also higher potential rewards, while others are more stable but may offer slower growth. Your risk tolerance should align with your overall financial situation and investment goals.

- Long-Term Perspective: Keep a long-term perspective. Investing in the stock market is not a get-rich-quick scheme. It requires patience and discipline. Avoid making impulsive decisions based on short-term market fluctuations.

In conclusion, selecting worthwhile stocks involves careful planning and continuous learning. It’s important to set clear goals, choose a sector that interests you, stay informed, and focus on the financial health of the companies within that sector. By following these steps and maintaining a long-term perspective, you can increase your chances of building a successful investment portfolio that aligns with your financial objectives. Remember that investing always carries risks, so it’s essential to do your due diligence and consider seeking advice from a financial advisor if you’re uncertain about your investment decisions.